Power Corp’s Desmarais Through Investors Group Inc. CEO Murray Taylor

Continue to Demonstrate Loyalty to the Nefarious Status Quo

© 2010 Brad Kempo B.A. LL.B.

Barrister & Solicitor

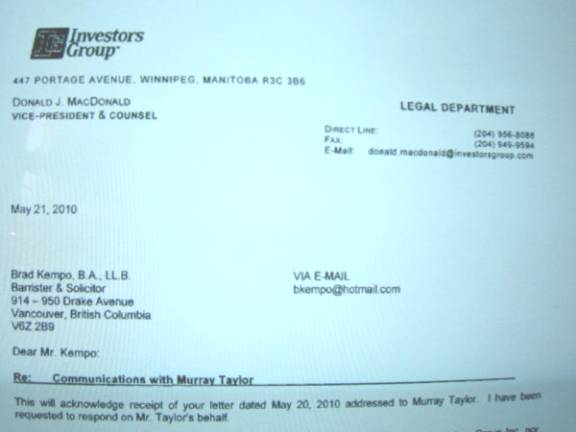

The edification of government and the administration of justice commenced in August ’07 and concluded in July ’09. The initiative began again in conjunction with delivering formal notice to complicit parties in the private sector in November ’09. It became apparent relatively swiftly that Canada’s wealthiest families and their executives managing the biggest corporations in the country were going to stand their ground despite being put on notice since early 2006 the international community was going to deliver serious consequences. On May 21, ’10 there was more evidence of the “all or nothing” attitude amongst those who operate the Ottawa-Toronto-Montreal-(Beijing) triangle of power and wealth.

“All or nothing” has a particular meaning amongst triangle operators. It’s come to signify they’d rather be uber-wealthy and exercise absolute power – free to engage in systemic corruption and criminality of the most egregious kind – and risk it all than comply with our constitution and domestic and international law. It was an attitude repeatedly observed during the public sector edification campaign and when triggering every single relevant accountability mechanism in Canada. And it was experienced again when introducing the Fiefdom treatise to this country’s largest corporations, banks and investment firms (see full list of these and other private sector contactees below).

Triangle operators’ belief they are invincible, insulated and immune was in evidence again on May 21, 2010 when the President of one of Power Corp’s companies, Murray Taylor of Investors Group Inc., delivered a response to the request he be part of the solution to what ails government, the administration of justice, security apparatus and economy.

The relevant representation is:

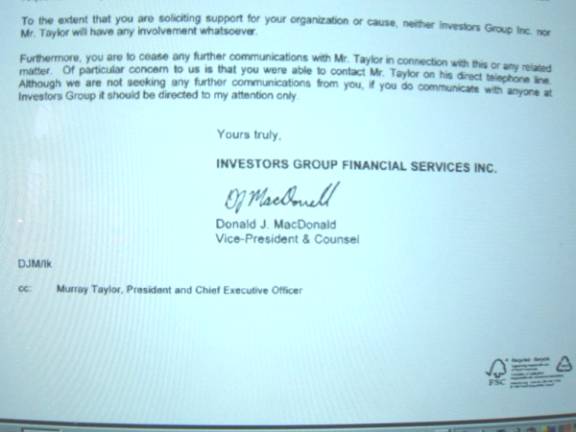

To the extent that you are soliciting support for your organization or cause, neither Investors Group Inc. nor Mr. Taylor will have any involvement whatsoever.

Furthermore, you are to cease any further communications with Mr. Taylor in connection with this or any related matter.

The reply was:

Mr. Macdonald:

This is to confirm our 20-minute discussion about your correspondence of today's date from Mr. Taylor. I stated my clients' case as diplomatically as possible, but also conveying the seriousness of the circumstances, trusting he will reconsider what appeared to be a position that is adverse in interest to what has been legitimately sought for the last five years and what will be lawfully undertaken to protect national and economic security interests.

Time will tell on which side of the reform and accountability fence he wishes to be. As indicated, those protecting the status quo involving China viz. Sidewinder Report findings and their political and international implications will discover going forward the environments in which they operate very inhospitable.

Brad Kempo B.A. LL.B.

Barrister & Solicitor [Alberta, Inactive]

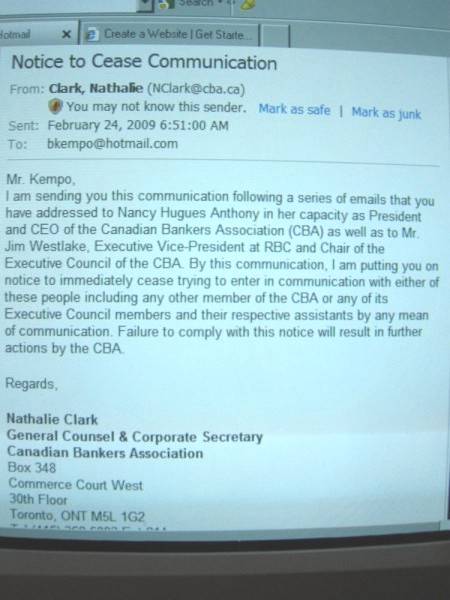

The tone of the correspondence from Mr. Taylor's counsel was expressly hostile and contained a message identical to what was observed and recorded so often before, like when contacting the Canadian Bankers Association.

February 24, 2009

Canadian Bankers Association

30th Floor, Commerce Court West

Toronto, Ontario M5L 1G2

Attention: Nathalie Clark, General Counsel & Corporate Secretary

Via-email: NClark@cba.ca

Dear Madam:

Re: Response to E-Mail 24 February 2009

_________________________________________________________________________________

Thank-you for the above-captioned and the telephone conversation that ensued as a result of its delivery.

To confirm, I represent international clients as ad hoc agent to advance their interests and also as amicus for Canada in pursuing the reform and accountability.

The original and primary purposes of sending information to CBA president Nancy Hughes Anthony and its Chairman Jim Westlake were (i) to edify with respect to the true nature of Canadian governance so the association can conduct its own due diligence, have a full discussion and debate on these critical matters of state and international affairs and adopt policies and implement strategies that mitigate adverse consequences of government policy and action referred to; and (ii) to discover and expose those in Canadian society who are complicit in illegal, unconstitutional and internationally unlawful conduct and those who are loyal to them and use their office to protect and insulate them and those policies and interests.

The first contact I had with the CBA was with your president on January 26, 2009; who was hostile form the outset and hung up on me in only a couple minutes after jamming my introduction with interruptions that were rude and clearly intended to frustrate the edification process.

Because of her reaction I approached Mr. Westlake. Your e-mail was undeniably hostile and contains the same tone as your president; and it is reasonably inferred she instructed you to send that threatening communiqué.

Over the last eighteen months of the dissemination initiative and throughout that time when accountability mechanisms were triggered to bring a measure of accountability and reform to what are, inter alia, seriously dysfunctional political and economic systems, my clients and I have witnessed two camps: the enthusiastically receptive, indicative of having no knowledge of the non-transparent constituent of Canadian governance and shocked by what was discovered through the three year research project and as a result of the Federal Court lawsuit; and hostile, whistleblower retaliation and accountability-reform saboteurs – who behave with guilty conscience and use threats and intimidation to prevent dissemination and to maintain the status quo. The president’s reactions fall into the latter; and your correspondence is corroboration of the highest order.

The president’s conduct and your remarks and threats are a trademark sentiment of complicity and/or loyalty and will be forwarded to the appropriate authorities for closer examination and prosecution.

I again refer you to The Security of Information Act; which provides for sentences up to life for violators.

While the CBA is a “lobbying” organization, it is also much more than that. Banking is a foundational dimension of every society. The industry comprises factions that converge to operate, regulate and supervise it and contains a plethora of political, professional and social networks in which parochial and improprietous domestic and international interests of the complicit have been and continue to be advanced and strengthened.

Your association is going to be fundamentally deconstructed and reconstructed by my clients to prevent it from engaging in unconstitutional and unlawful activities.

Yours truly,

Brad Kempo

Note: this correspondence was confirmed received:

Read: from Brad Kempo Barr&Sol National Security Confidential

From: Clark, Nathalie (NClark@cba.ca)

Sent: February 24, 2009 11:46:56 AM

To: Brad Kempo (bkempo@hotmail.com)

Your message To: Clark, Nathalie; leslie.tate@rbc.com

Sent: Tue, 24 Feb 2009 14:44:23 -0500 was read on Tue, 24 Feb 2009 14:46:55 -0500

Private Sector Contactees: November 2009 – January 2010

Royal Bank of Canada (David Allgood, counsel 416.947.7368)

Thomson Corporation (Michael Doody, counsel 416.360.8700)

Power Corporation of Canada (Stephane Lemay, counsel 514.286.6716)

Manulife Financial Corporation (Bill Dawson, counsel 416.415.3766)

George Weston Ltd. (Robert Balcom, counsel 416.575.9580)

Encana Corporation (Graham Baugh, counsel 403.645.8302)

Magna International Inc. (Richard Trecroce 905.726.7217)

BCE Inc. / Bell Canada (Martine Turcotte, counsel 905.726.2462)

Rogers Communications Inc. (David Miller, counsel 416.935.3546)

Telus Corporation (Darren Entwhistle Pres.& CEO 604.697.8037)

McCain Foods Ltd. (Mike Campbell, counsel 506.392.2852)

Canwest Global Communications Corporation (Richard Leipsic, counsel 204.953.7773)

Suncor / PetroCanada (Shawn Poirier, counsel 403.296.8000)

Canada Steamship Lines (Rod Jones, President & CEO and Pierre Prefontaine, counsel 514.982.3800)

Potash Corporation of Saskatchewan (Joseph Podwika counsel & Sr. VP 847.849.4290)

South Gobi Energy Resources Ltd. (Paul Goldman, counsel 604.608.455)

Research in Motion (Grant Gardiner, counsel 519.888.7465, ext. 13241)

Canadian Natural Resources (Paul Mendes, counsel 403.514.7605)

Shaw Communications Inc. (Peter Johnson, counsel 403.750.4500)

Onex Corporation (Andrea Daly, counsel 416.362.7711)

Bank of Nova Scotia (Neil Anders, Director Gov’t Affairs 877.700.0043)

Canadian Tire Corp. Ltd. (Robyn Collver, counsel 416.480.8398)

Enbridge Inc. (David Robottom, counsel 403.231.3900)

Husky Energy Inc. (Susan Prather, counsel 403.298.7308)

Chevron Canada Resources (David McInnes, Gov’t Relations 403.234.5780)

Bank of Montreal (Simon Fish, counsel)

Empire Company Limited (Karin McCaskill, counsel 905.214.6729)

Brookfield Asset Management (Joe Freedman, counsel, Sr. Managing Partner 416.363.9491)

Toronto Dominion Bank (Christopher Montague, counsel & Executive VP 416.308.3010)

Canadian Imperial Bank of Commerce (Michael Capatides, counsel, Sr. Executive VP 416.956.3316)

National Bank of Canada (Suzanne Cote, counsel 514.394.6374)

Talisman Energy Inc. (John Horlick, counsel 403.237.1234)

Agrium, Inc. (Leslie O’Donoghue, counsel and Greg Daniel, Corp Secretary 403.225.7000)

Trans-Canada Pipeline Inc. (Don DeGrandis, VP & Corporate Secretary 403.920.7685)

Sun Life Financial Inc. (Thomas Bogart, counsel and Michael McLoughlin, VP Legal Dept. 416.979.9966)

Fairfax Financial Holdings (Paul Rivett, counsel 416.367.4941)

Nexen Inc. (Eric Miller, counsel, Sr. VP 403.699.4000)

Vieterra Inc. (Raymond Dean, counsel 306.569.4411)

Cargill Limited (Philip Pauls, counsel 204.947.0141)

Teck Resources Limited (Bev Wilson 604.699.4000)

ConocoPhillips Canada Resources Corp. (Graham Vanhagen & Roger Monette, counsel 403.233.4000)

Canadian Western Bank (Kirby Hill, Public Relations 780.441.3770)

HSBC (Lindsay Gordon President & CEO 604.641.1851)

Bank of Canada, John (Jusseup, counsel 613.782.7306)

Lion’s Gate Entertainment Corporation (Wayne Levin, counsel 604.609.6100)

Laurentian Bank of Canada (Lorraine Pilon, counsel & Executive VP 514.204.4500, ext. 7160)

Dundee Corporation (Sivan Fox, counsel. 416.863.6990)

Bank of Montreal (Simon Fish, VP & counsel 416.867.4900)

Cadillac Fairview Corporation Limited (Rory Dyck, counsel 416.598.8240)

Viterra, Inc. (Raymond Dean, Sr. VP & counsel 306.569.4411)

CIT Corporate Finance, Canada (Brian Kelling counsel & Sr. VP 416.507.5813)

Raymond James (Paul Allison, VP 416.777.7000)

Wellington West Capital Inc. (Charlie Spring Founder & CEO 204.925.2250)

FirstEnergy Capital Corp. (John Chambers, President 403.262.0600)

GMP Securities (Harris Fricker, President & Vice-Chairman 416.367.8600)

Merrill Lynch Canada Inc. (Lynn Patterson, President and Mark Dickerson, counsel 416.369.3907)

Industry Investment Association of Canada (Ian Bruce, Chairman 403.261.4850)

AIMCo (Carol Hunt, Alex Ragan & Jeff Wispinski, counsel 780.427.3087; 416.304.6136)

JOG Capital Inc. (Ryan Crawford, Managing Director 403.232.3340)

Yellow Point Equity Partners (Tyler Smyrski, CFO and Brian Begert & David Chapman, Managing Partners 604.659.1850)

GMP Capital Inc. (Harris Fricker, President & Vice-Chairman; Industry Investment Association of Canada, Director)

32 Degrees Capital (Trent Baker VP 403.695.1074)

FirstEnergy Capital Corp. (John Chambers, President, Managing Director; Industry Investment Association of Canada, Director)

Manvest Corporation (Graham R. Bennett, counsel & Sr. VP, 403.231.7600)

GrowthWorks (David Levi, President & CEO 604.633.1418)

Lions Capital (Jim Heppell, President 604.688.6877)

Tricor Pacific Capital (Roderick Sneft, Partner 604.688.7669, ext. 104)

Birch Hill Equity Partners (Lori Evans, counsel 416-775.3833)

Ken Fowler Enterprises (Bruce Campbell, VP 905.321.3515)

Clairvest Group Inc. (Heather Crawford, counsel 416.925.9270)

Cordiant (Bertrand Millot, VP, Portfolio Management 514.286.1142)

Callisto Capital (Blake Sumler, Sr. VP 416.868.4939)

CAI Capital Management Co. (Simon Romano, counsel 416.659.5596)

Alberta Enterprise Corporation (Paul Haggis, Chairman 780.638.3001)

EdgeStone Capital Partners (Leslie Giller, counsel 416.860.3740)

Invico Capital Corporation (Jason Brooks, President, Allison Taylor, Executive VP, & Jonathan See, Sr. Associate 403.538.4837)

Wachovia Financial Capital Corporation (Niall Hamilton 416.364.6080)

Desjardins Capital (Marcelle Gauthier, Manager, Corporate Affairs & Investor Relations 514.281.7807)

Covington Capital Phil Reddon, Managing Partner 416.365.9155)

Elgner Group (Claude Elgner & Roger Elgner, Managing Directors)

G3 Capital (Vartan Pogharian, Associate 416.865.9888)

Integrated Partners (Victor Koloshuk, Chairman, President & CEO 416.360.7667)

Kensington Capital Partners (Tom Kennedy, Humberto Aquino & Rick Nathan, Managing Directors & Tim Stockman, VP Finance 416.362.9000)

Teck Resources Limited (Bev Wilson 604.699.4000)

Richardson Capital (David G. Brown, President & CEO 204.953.7969)

JLA Ventures (John Albright, Managing Partner 416.367.2440)

Claridge Inc. (Stephen Bronfman 514.878.5200)

KERN Partners (Pentti Karkkainen, Jeff van Steenbergen & Johannes Nieuwenburg, General Partners, and Chris Hooper, VP 403.517.1500)

McLean Watson (John Stewart, Partner 416.363.2000)

Longbow Capital (Larry Birchall, President, Curtis Birchall, Principal & Tyson

Birchall, VP 403.264.1888)

Novacap (Marc Beauchamp, President & Managing Partner 450.651.5000)

ONCAP (Michael Lay, Managing Partner 416.214.4300)

TriWest Capital (Jeff Belford & Cody Church, Managing Directors 403.225.1144)

Ventures West (Howard L. Riback, Sam Znaimer, David Berkowitz & Ken Galbraith, General Partners 604.688.9495)

Dancap Private Equity (Aubrey Dan, President & Elias Toby, VP & COO 416.590.9398)

Osprey Capital (Stephen Jakob, Founding Partner 416.451.0263)

PRIVEQ Capital (Brad Ashley, Managing Partner & Lee Grunberg, VP 416.447.3330)

Propulsion Ventures (Charles Sirios, Chairman & CEO & Michael Cordeau, counsel 514.397.8450)

ROI Capital (Fernando Cipriano, President, John Sterling, CEO, & Wilfred Vos, Sr. VP 416.361.6162)

Roynat Capital (Earl Lande, President & CEO, Jeff Chernin, Sr. VP & Wray Stannard, VP 416.933.2730)

Signal Hill (James C. Johnson, Managing Partner, Zaheed Poptia, VP 416.847.1170)

Tech Capital Partners (Andrew Abouchar, Tim Jackson & Jacqueline Murphy, Partners 519.883.8656)

BC Investment Management (Doug Pearce, CEO & Robert des Trois Maisons, counsel 250.356.0263)

Yaletown Venture Partners (Hans Knapp, COO & Legal Affairs 604.688.7807, ext. 106)

Turtle Creek Asset Management (Jeffrey Cole, Managing Partner 416.363.7400)

VentureLink (John Varghese, Jim Whitaker & Geoff Horton, Managing Partners 416.681.6341)

Torquest Partners (Brent Belzberg, Sr. Managing Partner, & Eric Berke, Managing

Partner 416.956.7022)

ARC Financial Corp. (Mac Van Wielingen, Co-Founder & Co-Chairman 403.292.0680)

Kilmer Capital (Larry Tanenbaum, Chairman, Michael Griffiths, Vice-Chair, & Anthony Sigel, Managing Partner 416.635.6100)

Lumira Capital (Peter Van der Velden, President & CEO 416.213.4189)

PFM Capital (Randy Beattie, President & CEO, Rob Duguid, VP Investments)

Teralys Capital (Jacques Bernier, Managing Partner 514.509.2081)